Executive Summary

The COVID-19 pandemic and the ensuing economic disruption have drawn more attention to longstanding issues related to housing and internet access and how these issues can impact health. As the primary source of health insurance for low-income populations, Medicaid covers a considerable share of people living in homes that are unaffordable, inadequate, or have limited access to the internet. This brief examines housing adequacy, affordability, and internet access within the homes of Medicaid enrollees using data from the 2019 American Community Survey (prior to the COVID-19 pandemic) and assesses the limited role that Medicaid can play in helping to address these challenges. Key findings include the following:

While housing insecurity and other “social determinants” can affect health, policies and programs outside of Medicaid – and the health care sector generally – have the greatest impact on housing issues among the broader Medicaid population. Recent legislation has created or extended funding for several federal housing programs, which likely helped to stabilize housing for many people during the pandemic. Additionally. one of the key priorities in the proposed infrastructure bill, the Infrastructure Investment and Jobs Act, would address some issues related to broadband access in rural and low-income communities if signed into law. The Centers for Disease Control and Prevention also implemented a temporary eviction moratorium that likely contributed to greater housing stability for people behind on rent; however, the Supreme Court ended the moratorium in August 2021, requiring that Congress authorize the moratorium to continue.

Why is housing important for health and the COVID-19 pandemic?

Housing can impact health in several ways. For example, housing adequacy may have a direct link to health through its effect on access to clean water, ability to store food or medications, prepare healthy meals, or maintain personal hygiene. Problems with housing affordability (typically defined as spending more than 30% of household income on housing) can lead to housing instability, overcrowding, and potentially homelessness, all of which have been associated with a range of physical and mental conditions. The causes of housing adequacy and affordability issues are extremely complex vary greatly by locality, with differences often reflecting state and local policy decisions, local economic conditions, availability of federal housing assistance, and historical and ongoing practices of housing discrimination.

Households with lower incomes generally have higher rates of living in unaffordable housing and having serious housing deficiencies or limited internet access. As the primary source of health insurance coverage for low-income populations, Medicaid covers many enrollees who are likely experiencing housing issues such as these. While Medicaid has traditionally been able to cover certain non-clinical services (including housing-supports) through home and community-based services (HCBS) programs that support seniors and people with disabilities, Medicaid generally cannot pay the direct costs of non-medical services like housing and food. However, there are more narrow ways in which Medicaid can be leveraged to help support access to some housing supports. Other programs outside of Medicaid – and the health care sector – are designed to address housing issues for low-income populations. At the federal level, for example, programs such as the Low-Income Housing Tax Credit Program, Housing Choice (Section 8) Voucher Program, and public housing are designed to improve access to affordable housing, although these programs have historically faced a range of unique challenges, including underfunding, long wait lists to receive benefits, and challenges locating housing units in desirable neighborhoods.

The COVID-19 pandemic has drawn more attention to housing issues related to affordability, quality, and internet access at home. For example, data from the Census Bureau’s Household Pulse Survey estimate that, between September 1 and September 13, 2021 (the latest data available), 14.6 million adults lived in households that were behind on rent or mortgage payments, and 4.5 million of these adults reported that they were “very likely” or “somewhat likely” to be evicted or experience foreclosure in the next two months. Moreover, as people spend more time in and around their homes during the pandemic, living in safe, adequate housing with complete amenities has also become increasingly important for personal health and social distancing. For example, living in a crowded household can potentially increase transmission of the coronavirus to other member of the household and limit their ability to effectively quarantine. Similarly, having internet access in the home has become a common way to receive health care and attend school, as well as to work from home where possible, while following social distancing guidelines during much of the pandemic.

What do the data say about housing affordability, adequacy, and access to internet for Medicaid enrollees prior to the pandemic?

In this brief, we follow the definitions for incomplete plumbing facilities, incomplete kitchen facilities, overcrowding, and unaffordable housing as defined by the U.S. Census Bureau’s ACS 2019 Subject Definitions. Notably, this brief’s definition of “inadequate housing” (defined below) differs from the U.S. Department of Housing and Urban Development’s (HUD’s) definition captured through the American Housing Survey (AHS). We did not use AHS data because the survey does not capture health insurance information for respondents.

Inadequate housing is either (1) a housing unit lacking complete plumbing and/or kitchen facilities as reported in the ACS or (2) “overcrowded” housing units. In the ACS, complete plumbing and kitchen facilities include hot and cold running water, a shower or bathtub, a sink with a faucet, a stovetop or range, and a refrigerator. Overcrowded housing units are those with more than 1 occupant per room (not counting bathrooms, porches, balconies, hallways, or unfinished basements, etc.).

Unaffordable housing is defined as paying more than 30% of household income on either (1) gross rent (contract rent plus most utilities) or (2) owner costs (mortgage payments, most utilities, real estate taxes, some insurance coverage, condominium fees, deeds of trust, and contracts to purchase). Housing units with zero or negative income are considered to live in unaffordable housing, while housing units who do not pay cash rent are assumed to live in affordable housing.

Internet access includes individuals living in homes that receive internet services through internet service providers or through a cell phone company, whether or not the household pays for internet services.

Limited computer access includes individuals living in homes that either (1) do not have a computer or (2) the only means to access the internet is with a smartphone (versus having a desktop, laptop, tablet, or another computer device available in the home, sometimes called “smartphone dependent”). We only report limited computer access for housing units with internet.

Even before the pandemic, the majority of Medicaid enrollees (57%) lived in inadequate or unaffordable housing, greatly exceeding the rate of the U.S. population overall (31%). In 2019, prior to the pandemic, nearly half (47%) of Medicaid enrollees lived in housing that was unaffordable, and 17% lived in crowded housing, both of which exceeded the national average (26% and 7%, respectively). Few Medicaid enrollees (1%) live in homes with incomplete plumbing or kitchen facilities, similar to the national average. Roughly one in 13 (8%) Medicaid enrollees live in a home that has two or all three of these conditions, exceeding the national rate of 3%. Overall, there are roughly 99 million people that live in inadequate or unaffordable housing across the U.S., and more than one-third (36% or 36 million) are enrolled in Medicaid. Although these data show national rates, other research shows that the share of people living in unaffordable housing varies greatly across localities.

The share of Medicaid enrollees living in homes that are inadequate or unaffordable varied across race/ethnicity in 2019. For example, seven in ten (70%) Native Hawaiian/Other Pacific Islander (NHOPI) enrollees live in a home with at least one of the selected housing conditions for inadequate or unaffordable housing, and two in ten (20%) live in homes with two or all three of the selected housing conditions. Additionally, American Indian and Alaska Native (AIAN) enrollees have the highest rates of incomplete plumbing or kitchen facilities, and AIAN enrollees were among the only demographic group we examined to exceed 2% on this measure. Generally, the shares of people of color enrolled in Medicaid exceeded the rates among White enrollees living in overcrowded and unaffordable housing.

Among different age groups, children enrolled in Medicaid (or CHIP) were the most likely to live in inadequate or unaffordable housing (63%). This pattern may reflect having multiple children (relative to the number of adults) within an inadequate or unaffordable housing unit. Enrollees in metro areas also experienced higher rates of inadequate or unaffordable housing compared to enrollees in non-metro areas, and the difference was especially large for unaffordable housing (49% vs. 38%). When looking at sex, although the differences were statistically significant at the p < .05 level (Appendix Table 1), rates of unaffordable housing were generally similar for males and females across all measures. For example, 56% of male enrollees and 58% of female enrollees lived in a home with any condition related to inadequate or affordable housing.

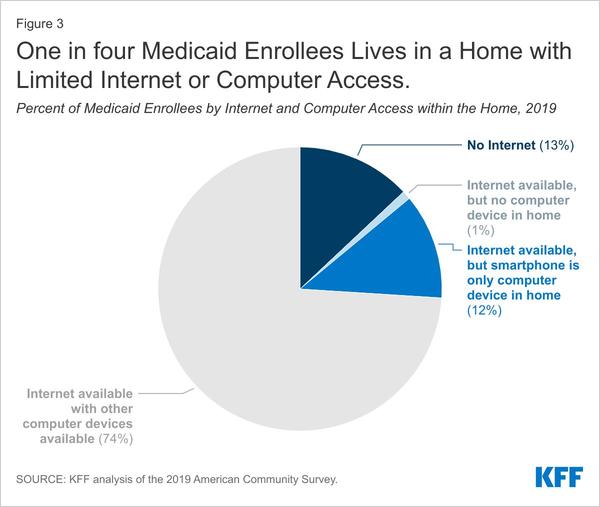

In 2019, roughly one in four Medicaid enrollees lived in a home without internet or with limited computer access. An estimated 13% of Medicaid enrollees have no internet access in their home, either through a computer or a cell phone. A similar share (13%) of Medicaid enrollees have internet access, but they either lack any type of computer device (1%) or the only computer in the home is a smartphone (12%), limiting the amount of tasks and activities that can be completed online. Previous KFF research showed Medicaid enrollees made up 32% of people across the U.S. without internet access in their home. When considering internet access in conjunction with limited computer access, Medicaid enrollees make up a slightly larger share. Of the 47 million individuals living in homes without internet or with limited computer access, 16 million (34%) are enrolled in Medicaid.

Leading up to the pandemic, internet access and the availability of computers in the homes of Medicaid enrollees varies by race/ethnicity, age, sex, and metro/non-metro areas in 2019. More than four in ten (43%) AIAN enrollees had limited internet or computer access, including 27% who had no internet access in their homes. Black people also had among the highest rates of limited internet or computer access (34%), including 16% with no internet access in their homes. Enrollees who are ages 65 and older also had high rates, with 41% facing internet or computer limitations, with nearly one-third (30%) lacking internet in their homes. Non-metro areas also had high rates of internet or computer limitations (31%), with 17% of enrollees lacking access to the internet in their homes. Conversely, there was little difference between male and female enrollees, with 25% and 26% of enrollees reporting limited internet or computer access, respectively, although differences were statistically significant at the p < .05 level (Appendix Table 2).

What are the policy levers for Medicaid to address housing challenges?

State Medicaid programs can add certain non-clinical services, including housing supports, into home and community-based services (HCBS) programs to support seniors and people with disabilities. CMS released guidance in January 2021 to highlight opportunities to address SDOH in Medicaid and CHIP. That guidance specified that federal Medicaid matching funds are available for certain housing-related services and supports that promote health and community integration. These services are generally available for children with special health care needs, adults with disabilities, or seniors. Housing-related services in HCBS programs might include: home accessibility modifications (such as wheelchair ramps or grab bars in the shower); one-time community transition costs (such as payment of a security deposit, utility activation fees, and essential household furnishings); and housing and tenancy supports (such as help with a housing search, identifying adequacy of public transit, and assisting in arranging for and supporting move-in); and tenancy sustaining services (education or training on the role, rights, and responsibilities of the tenant and landlord).

Beyond HCBS authorities, Medicaid has limited ability to address housing related challenges for most enrollees. Primarily, Medicaid can help to finance many health and behavioral health services that can be critical in helping people obtain and maintain housing. Medicaid can play an important role in coordinating medical and non-medical services and act as a bridge to social services (e.g., case management). States can also require managed care organizations to screen for and provide referrals for social services. States and plans can also build partnerships across sectors to meet basic needs for enrollees – including building linkages with supportive housing programs. Plans may also have additional flexibilities to provide certain non-medical services outside of contractually-covered services (through what are known as “in-lieu-of” and “value-added” services), although state Medicaid agencies must approve which services can be counted toward the capitation rate paid to the plans. While there are examples of health plans and provider systems investing in affordable housing programs (e.g., community investment or reinvestment requirements), these programs are often hard to scale or replicate broadly given issues with housing costs and supply. Further, screening and referral may not help to address housing challenges for Medicaid enrollees. While Medicaid is an entitlement, affordable housing/rental assistance programs are generally capped and not available to all who qualify and need assistance.

Some states have used or are seeking approval to use Medicaid waivers to address housing issues for high need populations. For example, in October 2018, CMS approved North Carolina’s Section 1115 waiver which provides financing for a new pilot program, called “Healthy Opportunities Pilots,” to cover non-medical services that may include housing modifications (such as carpet replacement and air conditioner repair to improve a child’s uncontrolled asthma control). To be eligible, enrollees must have at least one physical or behavioral health risk factor and at least one social risk factor (including homelessness or housing insecurity). Pilot services in North Carolina are expected to begin in the Spring of 2022.

Arizona is currently requesting Section 1115 waiver approval to enhance and expand housing services and supports for enrollees who are homeless or at risk of becoming homeless and also have another high-risk condition. Services could include short-term, transitional housing (up to 18 months) for individuals leaving homelessness or institutional settings; community transitional services to provide financial assistance for non-recurring move-in expenses to assist members in obtaining housing; eviction prevention services, which may include payment of back rent, utility bills; home modification services or pre-tenancy and tenancy support services. The waiver application is still pending but, if approved, will be authorized in the fall of 2021.

In 2016, California began its “Whole Person Care” (WPC) pilot program authorized under Section 1115 waiver authority. This program operates in certain counties and targets high-risk, high-utilizing populations including individuals experiencing or at risk of homelessness. Common services offered by WPC pilots include housing-related services such as housing navigation, tenancy support, and landlord incentives. In June 2021, California requested CMS approval to sunset Section 1115 authority for the WPC pilot program, indicating plans to instead expand the WPC approach statewide via the state’s managed care delivery system (with the introduction of enhanced care management statewide and a new menu of state-approved in-lieu-of services). This Section 1115 request also included federal funding to support capacity building for this expanded initiative, called “California Advancing and Innovating Medi-Cal” (CalAIM). California intends to implement CalAIM in January 2022.

In addition to stable and adequate housing, lack of internet and computers have implications to receive Medicaid services via telehealth. Prior to the pandemic, state coverage of telehealth in Medicaid varied widely. States took many factors into consideration when establishing temporary policies during the pandemic to increase telehealth coverage and access, including budget limitations, patient and provider acceptance, scope of practice laws, operational/technology challenges and costs for providers and patients, evidence of quality and effectiveness for services delivered via telehealth, and concerns involving potential for fraud and abuse, among others. Although state coverage of telehealth in Medicaid still varies widely, many states vastly expanded the use of telehealth in response to the COVID-19 crisis. However, telehealth requires technology and internet access that is a challenge for many Medicaid enrollees. While state Medicaid programs can expand the use of telehealth, Medicaid funds cannot address broader issues of internet and computer access.

Looking Ahead

A growing body of literature shows that improving housing quality, affordability, and internet access is fundamental step to improving individual and population health. As the primary source of health insurance for low-income Americans, Medicaid covers a considerable share of people living in homes that are inadequate, unaffordable, or have limited access to the internet. Although Medicaid has a limited role in helping to address these issues for the broader Medicaid population, states have some existing policy levers and can use partnerships to provide some access to housing services and supports for narrow subsets of enrollees.

In response to the pandemic, the federal government has taken several steps to stabilize housing for low-income households during the pandemic. For example, The American Rescue Plan Act created or increased funding for several federal housing programs, including an increase in funding for the Emergency Rental Assistance (ERA) program to over $45 billion, which is a program administered through the states to help renters pay late rent and utilities. It is unclear whether ERA funds will be enough to cover low-income renters’ late rent and utilities, as estimates of need vary widely. Additionally, data from the Census Bureau’s Household Pulse Survey estimate that only 2.8 million of the 8.2 million adults behind on rent had applied for rental assistance through the state or local government, and the majority were still awaiting a response (1.4 million) or were denied (900,000) as of late August. Thecurrent infrastructure proposal being debated in Congress also contains provisions to expand broadband internet access for rural and low-income communities, as well as funds for digital literacy training so that individuals can use the internet effectively for daily tasks. Moreover, the proposed infrastructure bill includes increased funding for replacing lead service lines, in additional to other steps, to improve access to safe drinking water. Earlier in the pandemic, the Centers for Disease Control and Prevention (CDC) issued a temporary eviction moratorium that prevented landlords from evicting tenants due to unpaid rent (although it did not stop rent, fees, penalties, or interest from accruing). However, the Supreme Court ended the eviction moratorium in August 2021, before it was set to expire, requiring that Congress authorize the moratorium to continue. Housing and internet issues pose major challenges to Medicaid enrollees and low-income populations generally – and these issues generally worsened during the pandemic. The breadth and scope of federal housing programs and supports will ultimately have implications for Medicaid enrollees’ home lives and associated health risks during the pandemic.

| Methods |

| This brief analyzes data from the 2019 American Community Survey (ACS) 1-year file. The unit of analysis in this brief is the individual, rather than households or the housing unit, and we use the person weights in the ACS data file. Household characteristics, such as household income, housing costs, and internet access, are the same for all members of the household. However, individual characteristics, such race, age, and sex, are reported differently for each member of the household. For example, children and adults in the household may be reported separately in our findings, as well as individuals in a household comprised of people identifying with different race/ethnicities or sexes. Our findings will differ from other studies where the unit of analysis is the housing unit, which often report demographics based on the householder (rather than individuals in the house) and use housing unit weights in the ACS data file. All differences between Medicaid enrollees that are mentioned in the brief are significant at the p < .05 level, which are also shown in appendix tables. Our analysis excluded people living in noninstitutional group quarters such as college dormitories and residential treatment centers because the ACS does not collect data on plumbing, kitchen facilities, or internet access for in these housing units. Notably, however, our analysis included both renters and owners. As noted in the definitions box in the brief, the definitions for incomplete plumbing facilities, incomplete kitchen facilities, overcrowding, and unaffordable housing are defined by the U.S. Census Bureau’s ACS 2019 Subject Definitions. For unaffordable housing, we assumed that people with zero or negative income lived in unaffordable housing, and those who do not pay cash rent (but have positive household income) are assumed to live in affordable housing. Metro and non-metro classifications are not part of the ACS microdata files. Metro and non-metro areas are defined by the USDA Economic Research Service. For this analysis, metro areas were defined as public use microdata areas (PUMAs) where more than 50% of the 2010 population lived in metro areas, and the remaining PUMAs were defined as non-metro areas. We received a crosswalk of metro/non-metro populations for each PUMA from a personal communication with USDA staff (June 17, 2021), which we joined with the ACS data. Our analysis used the same methods described further in a another Peterson-KFF Health System Tracker brief. |